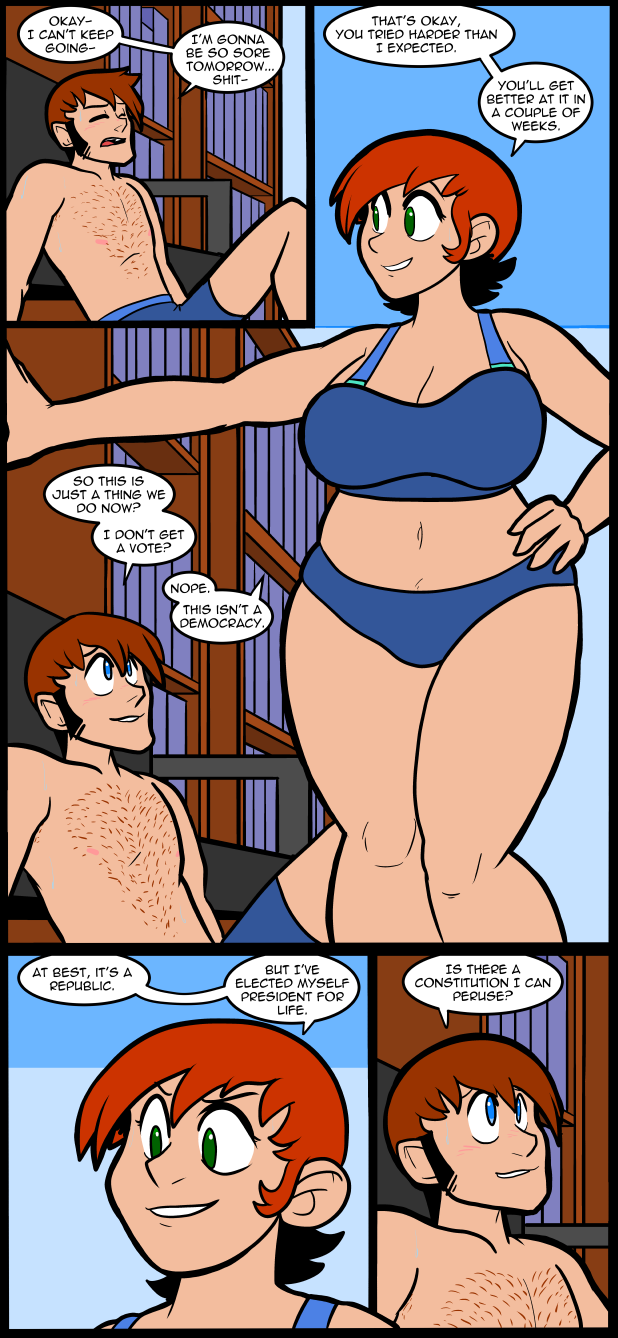

1427 Conditioning.

My allergies are absolutely killing me. We had the satellite tech in a couple of times and it kicked up dust in my room which compounded with the pollen in the air. It’s been miserable. Plus it’s fucking corn again this year which is the fucking worst when it comes to allergies. Corn fields all around the house. Brutal. I need to get some kind of military surplus rebreather or some shit.

Hey, do any of you guys have credit cards? I’m thinking about getting one so I can build up a credit score and all that, but I’m curious about what people have experienced with various cards. I kind of want a capital one card because Jack from 30 Rock told me it was good.

I’ve been playing Citizens Of Earth recently and it’s very good. It has some frustrating features because it emulates older games, but on balance it’s very well done and a lot of fun to experiment with. It’s also not very linear so I’ve wandered all over when I probably didn’t need to. Anyway, if you Earthbound or games like it, pick it up. Especially if it’s on sale.

I spent the better part of the day trying to get things done before the end of the month, and sorting out my old PC. I think it will stop turning on at random now. Fingers crossed.

Sometime tomorrow I’ll post some more Julius Derwood stuff for the Patreon kids. Once again I left it till the last possible moment. Also, if you don’t follow my twitter I put up a scrapped page with a very small bit of sketchy nakey Jo hand Jess. Just in case you’re curious about my process, or nakey bits.

Teen Corner

I’ve been sitting here for about 20 minutes trying to decide how to start this post. it’s almost shocking that I have nothing to say considering I rarely shut up. I honestly should be studying right now but id rather not, its just so boring and Jackie would rather play splatoon than watch me succeed in life although I don’t blame him splatoon is pretty great. i have a map test and a Spanish quiz tomorrow and I’m not very confident I’m going to pass but hopefully some how I can slide by with a B at least. I also have volleyball practice tomorrow for 2 hours, not gonna lie I’m not to thrilled about it but I need the physical education credit so I’m gonna have to push myself and keep playing. although id much rather come home and lay in bed watching supernatural after school Jensen ackles will just have to wait. i don’t think Jensen ackles should be allowed to wear a shirt ever, I’m pretty sure he’s breaking some law by hiding away all that sexiness. although it would be a little awkward fighting demons and such half naked but i bet the show would get even more fans my way. so as I mentioned in my last post my birthday is approaching, this weekend i went and got invitations and plats and napkins and such, we cant buy food yet because lets face it in this house it would never make it 2 weeks. I’m pretty excited i suppose, I don’t feel like I should be turning 17 though. where has the time gone? people always tell you that you should enjoy being a kid and enjoy school because one day you’ll miss it and i never believed them but as i approach adulthood i realize i spent way to many years trying to be a grown up when i really should have been enjoying life as a kid. it’s sad really that I’m only seeing it now, i wasted so many years wishing to be an adult and now I’m like why did i waste time trying to grow up faster than i should have? anyways that’s going down a depressing road so lets change the subject. Halloween is a few months away and I’m so very excited, i know i know I’m to old for trick or treating which is true but I’m never to old to dress up and have a scary movie marathon with good friends. i love Halloween simply because for one night you get to be anyone you wish to be, the endless possibilities excite me although i haven’t a clue what I’m going to be. there’s plenty of time to think of something though. play auditions are tomorrow and i am freaking out i don’t even know who i want to audition for anymore. maybe i shouldn’t audition at all? i don’t know…im worried that with volleyball i wont have time to practice for a lead role although i would love to be the queen because who doesn’t wanna wear a crown? who thinks i could rock the role of the queen? I’ve now avoided studying for the last hour so sadly i should end this post and get to it. bye interweb people see ya in the comments hopefully!

40 Comments

Awesome to hear from the teen. And first?

Oh, you’re about to do some perusing. You’re gonna get an eye full.

*rimshot*

Hey Jackie, if you are apart of a credit union, they usually have a credit card system in their network that you can join. But if you are not, just do your research. I don’t technically have a credit card. But I have a debit card funded my Visa, and I have never had a problem with them. But in general, If you don’t travel alot. You don’t need a card that gives you flyer miles. Also, start off with a low credit limit. Like $500-$1,000 that will help you not rack up a huge bill that you can never pay back. Also, dont go with any store credit card. Like Walmart, or Best Buy, they are just designed to screw you.

That’s all the info I know on credit cards. Sorry if it’s all stuff you have heard before.

As far as credit cards go, Capital One is pretty good. I’ve had a card through them for a few years and I haven’t had any problems. I personally prefer having a credit card through my bank, as it means I don’t have to wait extra business days when making a payment (as you can just transfer money from your bank account straight to the card to pay a bill with no wait).

The best way to improve credit score through a card is to make all purchases through the card, even if you have the money on your debit, and pay off the balance each month. This both keeps interest down and you don’t end up in surplus debt. The key is to not credit card more than you have actual money for.

Hope that helps.

“The key is to not credit card more than you have actual money for.”

This is literally the best advice ever as far as credit cards go. It seems absurdly simple but don’t by things you don’t have the money for. Unless the cash is honestly sitting in your bank account and not going anywhere else, don’t buy the thing. Don’t count on money coming in, don’t. I think technically you can improve your score by floating a 20% balance on your credit. (As in if your limit is 100, when your bill comes due pay everything off but 20 dollars.) But it is also a quick way to misery and as far as I can tell doesn’t improve your score enough to justify doing it.

In my experience, Capital One will give you way more than enough rope to hang yourself with. When I was 18 they offered me a 2000.00 credit limit and I made 8 dollars an hour working in the food court in the mall… those were dark times.

First and most important, look for any annual fees. Get the card with the lowest ones (none if possible). This should take priority over any rewards, since those fees can sometimes exceed what you may get in return. If you don’t travel monthly, don’t bother with a card that gives travel rewards, since it will otherwise take forever to earn a worthwhile number of points (and travel cards have higher annual fees). Remember, your goal at this point is to build your credit score, not collect bonuses.

It helps if you start small. Instead of putting all your purchases on the card every month, start with just your gasoline purchases. Then set that amount aside from your checking / debit account as if you’d already spent the money. That way you’ll have it when the payment is due. Once you’ve mastered that, then start adding routine transactions one at a time. Mabye start with your smallest regular utility bill, then add others as you feel comfortable.

Check with your current bank; they may offer a lower interest rate than going with a different bank.

Got a credit card specifically to build up credit, found it to be an astoundingly huge pain in the ass. However, I went with a store card, and they tried to charge fees for quite literally everything. As in “there is a fee for paying your bill no matter how you pay”.

I use a credit card for 100% of my purchases. The trick to building credit is to pay at minimum the statement balance. You want to carry a balance at statement time of about 1-10% of your total credit limit (never more then 10, never 0).

CreditKarma is a good site for tracking information that is also free.

As far as a specific card, look at cards that give cash back. I have a PayPal one and an Amazon one. When I was working it made sense as each one gives more back on different categories. Now that I’m at school full time it doesn’t matter as much and I tend to just use one card.

Feel free to message me on Facebook for more information (on credit cards, or budgeting etc etc). We haven’t chatted in awhile anyway <3

To the teen;

What I have found best about being an adult, and having a job, is being able to be childish without having to rely on others to pay for your stuff. Also, if you like dressing up and pretending to be someone else, why not take up Cosplay?

I don’t know about cosplay seems a bit much for me

Cosplay is just dressing up as your favourite characters from TV/movies and meeting up with others who like to do the same. It’s like Halloween whenever you want it (just without the trick or treating)

That could be fun maybe I’ll give it a try

Capital One is by a mile the absolute worst card on the planet. They try to screw you over any which way. As long as you don’t get Capital One you’ll be just fine.

In this order, first is best

1. Etrade

2. Amex

3. Citi

4. Wells

7. Bofa

1000. Capital One

I think that this is my first time posting here… But I had to post to tell you to avoid capital one. They are the devil. They nearly tripled my APR one month for no apparent reason (other than that they could) and once pulled funds for a payment out of my bank account without my permission (when I reported it to my bank, they said they could do an investigation, but that capital one would not get in any trouble, even though it was technically fraud). Seriously, they can die in a fire.

I have a Mastercard through my bank. It’s a 500$ limit, and it does me fine. Use it for things like gas and groceries, and only if you have the money in your bank account. It’s worked for me, so far.

Hi Jackie,

I’d recommend getting a card through your bank or credit union. They know you there and can usually give you a card with a limit that fits your needs. If you’re building credit, you might have to go with an unsecured card (which means you pay the bank the amount of your limit and that lets you use the card to that amount. Each time you buy something on the card, you pay your balance off to restore your limit.) but if you’ve been with your bank for a while, you should be able to get a $500 limit without much trouble.

Ditto those who say buy something at least once a month on your card and keep your balance paid to build your rating. It’ll take a few years, but your credit rating will improve once you prove to the world that you honour your debts.

Try to avoid private cards and if you can, aim for a card that doesn’t charge you a fee for using it. Ask your bank rep to describe the various ones they have and pick one you like the sound of.

Speaking personally, I’d avoid Capital One. They are the most commonly known but they’re also woefully inadequate as far as infrastructure goes. When I moved from the U.S. to Canada, they could not transfer my balance to their Canadian counterpart (um, you’re both named “Capital One”, aren’t you?) and because I couldn’t hold a U.S. bank account to make payments (not resident in the country = not able to have a bank account there), they insisted that the only way I could pay was by registered money order delivered by courier to their California office. When I did so, they refused to take it. This was when I had an account at a Canadian bank (we only have six up here), could do wire transfers to America, and in the age of Internet. I was not impressed.

You mean a secured credit card right? I was about to recommend them but either you had a typo or I don’t know nearly as much as I thought I did.

Me and my misused prefixes. That’s right, Thomas. Sorry for the confusion.

My go to card is my amazon credit card from chase because it has pretty good cash back rewards, but the points you accumulate can also be used directly on amazon for purchases … which is a nice benefit. Just my opinion, but it makes purchasing decisions easier for me when I dont have to shell out the cash.

Agreeing with OP here: if you use Amazon a lot, you can rack up a lot of useful points with an Amazon card. But definitely do follow the advice of folks posting up above this and use it mainly for the stuff you would be buying anyway, with the intent of paying off the balance at the end of each month/period. It will improve/build your credit history and help you steer clear of trouble.

I think the Amazon card is great, but my application for the card was denied due to mediocre credit, so I ended up going for a credit card from my local bank to build up good credit. Sending out lots of credit card applications at once can hurt your credit rating, so I’d stick to safer bets for your first card, preferably something with your bank or credit union (of course the Amazon card may also be a safer bet and I was just unlucky, but such is my anecdote).

Also, it is optimal to only use 30-50% of your total credit line to improve your credit score, so try not to use your entire line each month. This means you probably won’t be using your new credit card for all of your purchases.

Definitely Discover IT card if you can get it. Pretty sweet perks.

According to “Poorcraft: the Funnybook Fundamentals of Living Well on Less” by C. Spike Trotman*, it’s adviseable to get rid of your credit cards. If you’re trying to build up your credit history for a mortgage or a car loan, the book says this:

“Saving up a 20% down payment for your home will satisfy most lenders. And you should NEVER take out a car loan!

Cars depreciate (lose value) very quickly. Taking out a loan to buy something that rapidly depreciates doesn’t make sense. Only buy a car you can afford without a loan.

Besides, you build good credit by having well-managed bank accounts and paying your bills on time, too. That’s good enough.”

Still, if you’re dead-set on building up your credit score with a credit card, I’m told that what some people will do is get a card and only use it for Netflix – or some similar small, monthly transaction – and pay it off on time each month. That way, the payments are small and easy to manage.

*(I highly recommend checking out Poorcraft – it’s a guide to getting by without spending too much money, written as a comic book! It’s got guides to buying/maintaining a house, transportation, food, entertainment, and more. The only thing that might be out of date is the Healthcare section, but supposedly Spike can give you more updated information.)

What Crash said!

As a used car salesman once told me: “Credit is expensive”. And with the US economy doing what it’s doing, it’s probably not a smart thing to go into debt at this time. Pay all your bills on time and your credit score will [eventually] go through the roof. You know you’ve made it when you start getting “pre-approved” credit card scams in your junk mail.

But if you MUST get a credit card, promise yourself to pay off the entire balance each month. Then it doesn’t matter what the interest rate is (and if you get a card with no annual fees, it’s like free credit.) As the financial advisor told me: “the first month you can’t pay off your entire credit card balance, cut them up and send them back.”

I use a credit union and I second the advice of others to use a credit union if you can. If you can’t, there’s something to be said for just getting it through whatever bank you use normally. Of course you want to look for the lowest possible interest rate, but using your normal bank will 1. make setting up an autopay very convenient and 2. make it easy for you to call and ask for a break if you mess up early on (easy to do when you throw a new card into the rotation). I think having a credit card is a great idea, personally… I’m seeing some advice higher in the comments that you don’t need one, but that hasn’t been my experience. When I was younger I had multiple bills in my name and paid them on time monthly for over 5 years, and never even had a credit rating until I got the credit card. If you use them right you can build credit impressively fast. Use them every single month, but never let the balance go higher then half of your credit limit (one third is better), and then pay in full every month.

Lastly, I don’t know what your credit score is like now, but if the best deal you’re offered is a secured credit card you should go for it. Some people really don’t want the secured card and they accept a much higher interest rate to get the unsecured line of credit, but you don’t need to. You want the card to build your history, right? If you handle your secured card well it will probably convert to an unsecured line in 12 months (could be 18 or 24, but 12 is common with no mistakes) and you’ll end up with a better rate.

Hey there

Instead of getting a credit card tobuild your credit, let me recommend something that I did when I was in a better situation.

Go down to your bank/credit Union and see if you can take out a small personal loan. Signature loans are usually good for between $500-5000 depending in the bank. Take the money, and then open up a new checking account and deposit it there. (Or most of it depending on your situation)

Set that account up to automatically pay the minimum balance plus 5% on a monthly basis.

Now.. set up your normal direct deposit to reflect that 5%. I.e. if you normally get $100 a week deposited into your primary checking then $5-$10 a week of that deposit should be redirected to the alternate checking account.

This will keep the money out of site out of mind and will name it available if there is an emergency. As well as establish a good faith payment system on paper.

It jumped my credit up quite a bit. And was virtually painless.

Keep it available.. not name it :(

Stupid phone

Figure out why you want a credit card (or why you are asking if you want a credit card). Assume that the reason you want one is a virtuous thing about yourself.

Find someone who can get you a credit card, who will persuade you to get one, and apparently embodies the virtue you assumed.

Decide based on what that person says.

The Grave Republic. Has a certain ring to it. Hail Carol!

___________

The Teen: Two birds with one stone? Be a queen for both the play and Halloween. Get it all out of your system. :)

Good idea thanks :)

Hello Jackie,

Might I recommend that you check out what Dave Ramsey says about credit cards and debt in general?

http://www.daveramsey.com/home/

If you let me know an address, I will be more than happen to send you a copy of his book the Total Money Makeover.

I have no debt now, the house is paid off. My credit score is slowly going down to zero and I don’t care!

As for Capital One and their tag line; What’s in your pocket.. I have Cash!

The bank I use is a credit Union, really the best way to go.

Good luck.

With regards to the allergens you have to deal with on a regular basis, have you tried one of those ionic air filters?

My house has central heating so there are no issues in the cooler months since I installed one as part of the gas heater last replacement.

I still use a washable filter for the big chunky stuff that gets pulled through the vents, like dust bunnies and such.

For the summer months I use one of those Bionaire units bought surplus, on sale, with warranty. Good for one room but cleaning the dust plates can be tricky.

Oh and do actually dust / vacuum the place if a tech can “kick up the dust”.

I don’t recommend the full face filter mask since those things get sweaty and uncomfortable after a while of extended use. A hazmat suit hood with air pack sure, you will look and feel like a dork but hey, comfort and cool all in one. Phone use might be a challenge unless you use Bluetooth. =P

Life is an adventure, so bribe the GM

From what I can tell credit cards charge interest by the month, so calculate how much building up your credit would cost you.

Let’s say you keep a constant 200 dollar credit at 10% interest, that means you will have to pay 20 dollars every month just to increase your credit rating. This is an extra expense that doesn’t give anything else back to you, keep this in mind. Credit does not mean extra spending money, it actually means less spending money.

You will have to do your own estimate if that is worth it.

If keeping that up for 5 years is enough to allow you to buy an acceptable house then I say (20x12x5) 1200 is not too much to buy your way into your desired credit rating.

If you need to float a 500 dollar debt at 20% interest for 10 years that means (100x12x10) 12000 dollars, in that case I think saving the money gets you closer to your dream house with less risk.

Imagine getting in finiancial trouble for a couple months while you have an open debt on your credit card, this would destroy your credit rating making it a complete waste of both time and money. Such things happen to everyone, as I’m sure you know.

Hi Teen,

If you don’t mind advice from a random guy on the internet, (snerk),

If you want to try out for the play, and: you can fit a play nicely into your schedule, and you do good voice projection for acting, + you are good at memorizing a part, [ ugh, how I hate memorizing lines for plays, ha,], then I’d say, GO FOR IT!

I’d try out.

I think that being in a play can be lots of fun! Dang, I wish I had a good ending for my comment.

Break a leg, Teen. :D

I’m sure someone else has already said this, but my advice is to get a card with someone whose reward system you’ll take advantage of. For instance, I have an Amazon card, and I get points for any purchase, but double for certain types, triple for others, etc. (with the most being for Amazon purchases, naturally). That way you maximize your rewards with the thing/place you purchase most and you can also redeem the rewards more effectively, too.

You don’t need a card to get a credit history. If you have your bills in your name you are already building a history. Water, gas, electricity, rent/mortgage all contribute to your credit worthiness. Student loans do too. To get credit history on a card you have to maintain a balance in the card. When you maintain that balance you pay interest. So literally you are paying extra for a history. There are other ways to show credit worthiness. Go talk to your banker or even car dealer and see what they can tell you from two different angles.

I NOW only pay cash or debit for anything; ask me why.

The only credit card I really use is Discover Card, but I’d recommend it. They don’t charge for using the card, they have have nice customer service, and they do the cashback bonus. I find it easy to use and build credit with, I got it when I was going into college so I’d say it’s a pretty good first credit card. It’s really pretty straight forward. You charge on the card. You’re sent a monthly statement. You pay the statement. You can pay by sending a check in an envelope they include with the statement. You can also pay by phone if you suddenly realize, oh my statement is due tomorrow and I totally didn’t send off the envelope. Paying by phone is actually really painless and easy. You can also do it online, but I’ve never tried that because I like having paper copies of stuff to reference. You don’t have to worry about anything too complicated, which I like.

Drawbacks are that there are some places that don’t accept Discover Card for whatever reason. Also apparently barely anyone in Canada does, but so long as you are in the US you should be fine with it.

General credit card stuff to be aware of, which you probably already know, but in case you don’t I’m going to include. Don’t buy stuff on credit. Be able to pay the credit charges in full each month. You don’t have to, you can only pay a portion called ‘minimal balance due.’ This is how you accidentally get yourself in debt. Identity theft is also a thing, so be careful about keeping information safe. I’ve never had a problem with my discover card (I have with another credit card) but always be careful.

I also have an American Express Card, but that’s more complicated. I’d recommend the Discover Card because it’s easy to handle and pretty low stress, which makes it a good first credit card.

I understand your allergy related suffering. I replaced our home HVAC filters with the more expensive odes with carbon filaments, and placed electrostatic filters in the rooms where I spend most of my time (living room and bed room). (http://www.theatlasstore.com/p/8454575/Two-UV-Atlas-Electrostatic-Ionic-Carbon-Filter-Air-Purifiers-.html?gclid=Cj0KEQjwyK-vBRCp4cymxermx-EBEiQATOQgh2FjYGCM11Wx7UKu0Ch-vtCff8BMR5xfvkq-quXjz7kaApE38P8HAQ).

You become kind of a shut-in when it gets bad outside, but breathing is so much better.

Oh yea, I also went so far as to replace all the carpeting with Pergo type flooring and select throw rugs. That really keeps the dust down and cleans up nicely.

Good luck!